what is a secondary property tax levy

Property tax bills cover the calendar year. Local laws and resolutions.

Understanding California S Property Taxes

If you have questions about education support call the Municipal Property Assessment Corporation at 1-866-296-6722.

. Property Tax Levies and Average Single Family Tax Bills Property Tax Levies by Class FY2010 to present Municipal Property tax levies by the five major property classes residential open space commercial industrial and personal property as reported on page 1 of the annual tax rate recapitulation sheet for municipalities. To help give tax professionals a better understanding of how the IRS is implementing the law we are providing internal training materials categorized by audiences - small businesses large businesses and. Use our Property Tax Calculator to view your annual tax levy and to see the breakdown of where your tax dollars go.

Upon payment of a fee the Department of Finance will issue a certificate reflecting the total real property taxes and penalties owing to the Province as of the date of issuance and whether the property was subject to a tax sale within. For the education portion of the tax are established by the Minister of Finance and help to fund the elementary and secondary education system in Ontario. Tax due date June 30.

Staff also prepares reports about revenues expenditures budgets attendance and enrollment staffing and school property taxes with information provided by Idahos School Districts and Charter Schools and other governmental entities. The IRS continues to implement the Tax Cuts and Jobs Act TCJAThis major tax legislation affects individuals businesses and tax exempt government entities. Tax bill mailing May 24.

Property owners who have not received a tax bill by the first week of June can request a copy of the bill by visiting property tax document request. To determine whether the taxing jurisdiction is collecting more or less in taxes compared to last year look at the percentage change from prior year of the tax levy. The tax class codes are explained at the top right of the page.

Voters approval was in 2010 and after Tuesdays election defeat that streak continues for. New York States property tax cap. A municipal portion and an education portion.

Your tax bill also has the tax rates for each taxing jurisdiction. Interest rates on court-ordered property tax refunds. The librarys secondary tax will increase by a penny in preparation for long-term.

A property can be both 4c3i and 4c3ii if appropriate. The countys proposed primary property tax rate levy is about 108 million higher than the neutral rate. Such basic services as police protection elementary and secondary education the community college transportation health and social.

Starting in Tax Year 2015 Proposition 117 and ARS. Property tax is a levy based on the assessed value of property. Property qualifying by making contributions and donations 4c3ii does pay the state general tax.

Property tax has two components. REAL PROPERTY CONSOLIDATED TAX BILL LEVY YEAR 2008 ANNUAL BILL TAX PERIOD 07012008-06302009. Interest rate on late payment of property taxes.

Property tax and assessment news. Taxes are calculated based on a 12 month period regardless of occupancy date and do not include in-year adjustments resulting from supplementary omitted or appeal activity. B - Tax class This section lists the classifications of your property ie residential farm commercial and educational support.

Standards for electronic real property tax administration. The last new fire tax levy to win Madison Twp. 42-11001 Subsection 7b now requires using the Limited Property Value Net Assessed Value in determining and levying primary and secondary property taxes on all property.

Changes in the tax rate between years are not accurate barometers of changes in the amount of taxes being collected. What is property tax. 2021 TAX LEVY TABLE OF CONTENTS Note.

Property qualifying as non-revenue 4c3i used less than six days for revenue-producing activities does not pay the state general tax. Review our current and past tax. 4c4 Post-secondary student housing.

Please be aware the Property Tax Certificate will not include the 2022 Annual Levy until April 1 2022.

Understanding California S Property Taxes

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Biennial Property Tax Report Texas County Progress

Understanding Your Property Tax Statement City Of Bloomington Mn

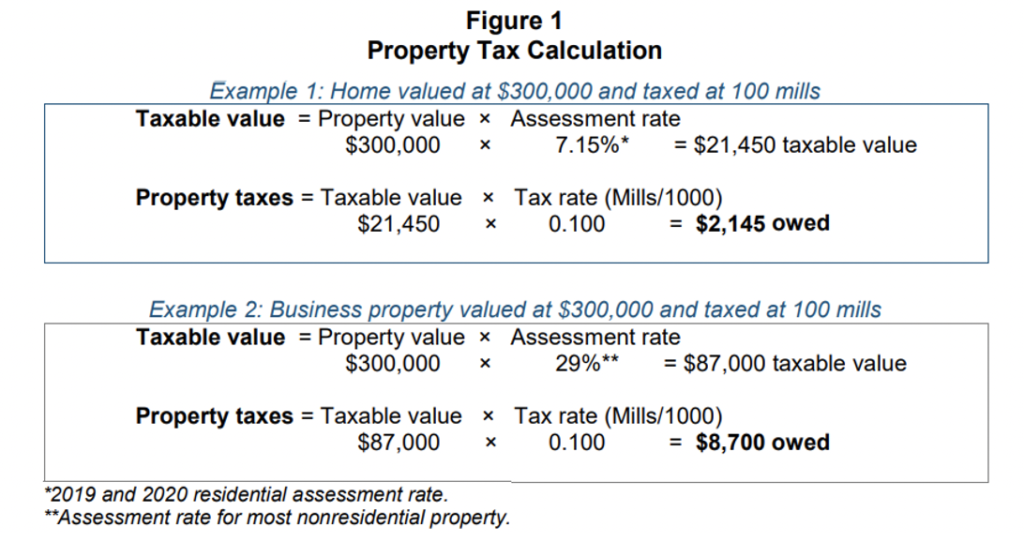

Property Tax Calculation Boulder County

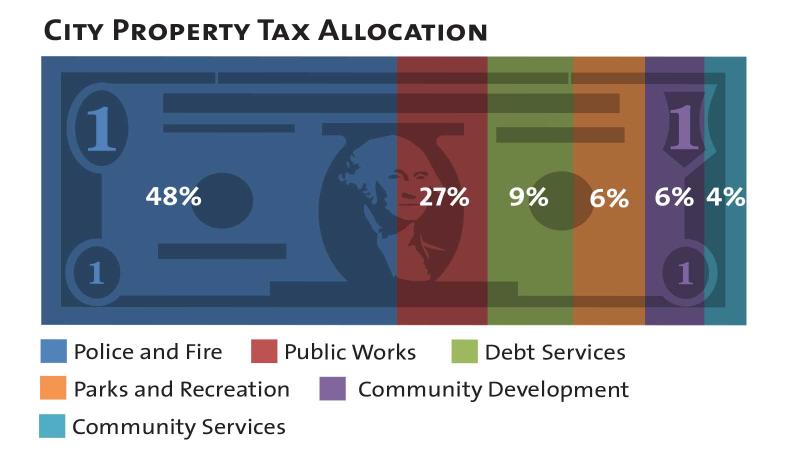

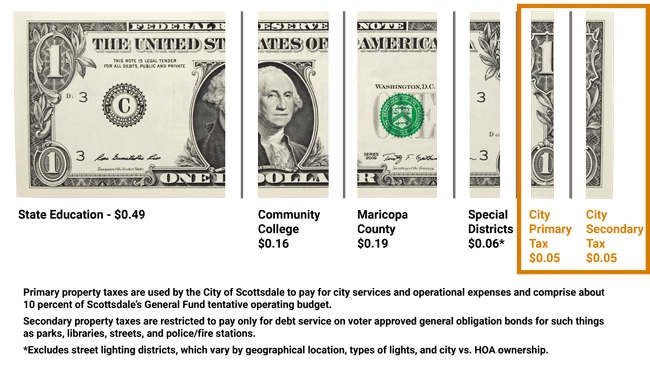

City Of Scottsdale Truth In Taxation Notice

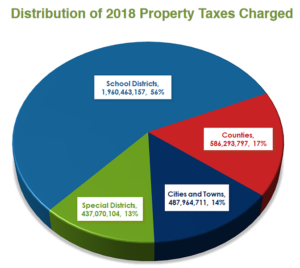

2018 County Property Tax Report Texas County Progress

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Demystifying Utah S Property Tax Law And Why We Have The Best Property Tax Laws In The Nation Utah Taxpayers

Understanding California S Property Taxes

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Pennsylvania Property Tax H R Block

Property Tax How To Calculate Local Considerations

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

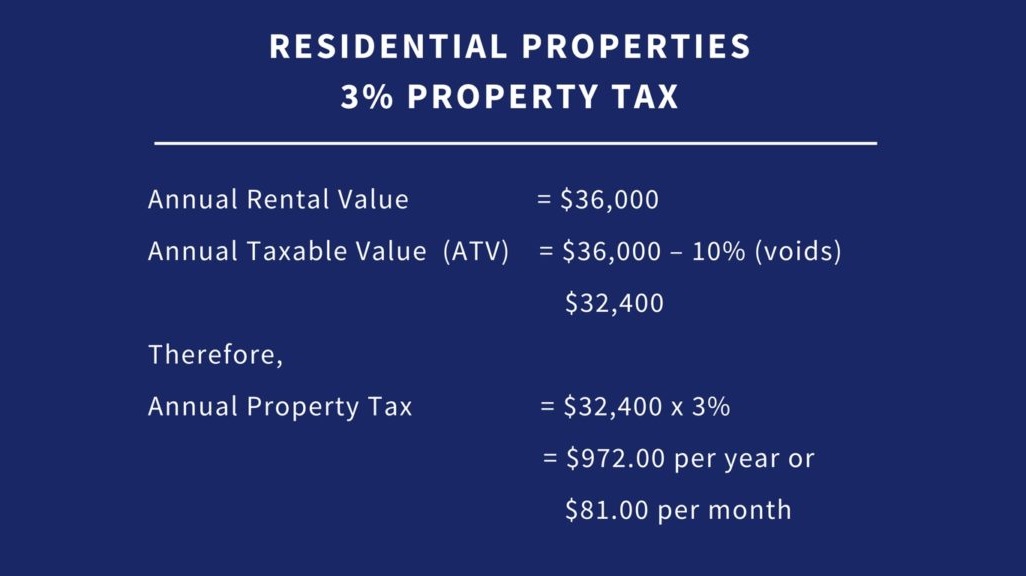

Updated 10 Things To Know About Property Tax Loop Trinidad Tobago

Around 40 Property Owners In Bengaluru Don T Pay Tax The Economic Times Paying Taxes Economic Times Bengaluru